The Income Tax Bill 2025 has been introduced to replace the Income Tax Act of 1961, aiming to modernize and simplify India’s tax system. The key objectives of the bill include reducing legal complexities, enhancing transparency, and improving compliance. Here are the major highlights of the bill:

- Simplification of Legal Language – The bill uses clearer and more concise wording to make tax laws easier to understand, reducing the need for legal interpretation.

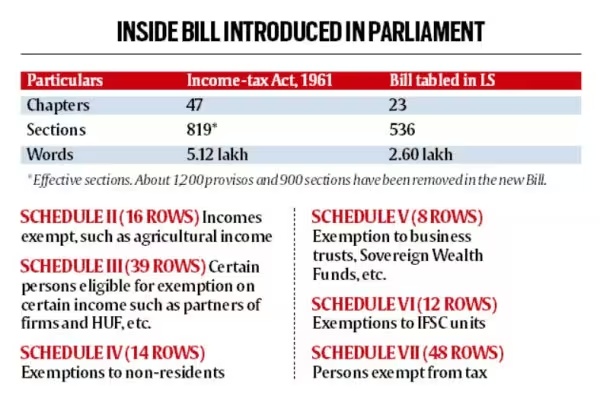

- Reduction in Length – The new law is designed to be nearly 50% shorter than the 1961 Act, making it more streamlined and reducing litigation.

- No New Taxes – The bill does not introduce any additional taxes but focuses on simplifying existing tax structures.

- Presumptive Taxation Changes –

- Section 44AD (for small businesses) now applies to turnover up to ₹3 crore (previously ₹2 crore).

- Section 44ADA (for professionals) applies to receipts up to ₹75 lakh (previously ₹50 lakh).

- Section 44AE (for transporters) continues for goods carriages.

- Virtual Digital Assets (VDA) Classification – Cryptocurrencies, NFTs, and digital assets are now legally classified as “assets,” meaning they will be taxed similarly to properties and stocks.

- Removal of Outdated Provisions – Obsolete taxes such as fringe benefit tax and other redundant sections have been eliminated.

- Public and Parliamentary Review – The bill has received 6,500 public suggestions and will be examined by a Joint Parliamentary Committee (JPC) before final approval